4 Key Deal Structures for Buying or Selling a Small Business

For small business owners on Main Street or in the lower middle market, navigating a business sale or acquisition is a pivotal moment. Whether you're planning to sell a small business, buy a company, or explore small business brokerage options, understanding the right deal structure is crucial for a successful transaction.

This introductory guide covers four practical small business acquisition structures:

Asset purchases

Stock purchases

Employee stock ownership plans (ESOPs)

Earnout agreements

We’ll explore how each works, their benefits for buyers and sellers, key considerations, and a comparison table to help you choose the best structure for your business sale or purchase.

Always consult with legal, financial, and tax professionals to ensure that the structure you choose is appropriate for your specific situation.

Asset Purchase

What It Is

An asset purchase is a common small business acquisition method where the buyer acquires specific assets, such as equipment, inventory, customer lists, or intellectual property, and may selectively assume certain liabilities (e.g., contracts). The seller retains the business entity, which can be dissolved or repurposed after the sale.

How It Works

In an asset purchase, the buyer and seller negotiate which assets and liabilities transfer. For example, a buyer acquiring a local coffee shop might purchase its equipment, recipes, and lease, but exclude any debts or legal claims.

The process involves due diligence to verify asset values, followed by a detailed asset purchase agreement. This structure is popular in small business sales due to its flexibility and clarity.

Benefits for Buyers

Selective Acquisition: Buyers can choose valuable assets (e.g., a retail store’s inventory or brand) while avoiding unwanted liabilities, such as unresolved lawsuits, making it a low-risk option for small business acquisition.

Tax Advantages: Buyers can often depreciate acquired assets, reducing taxable income over time, which is appealing for Main Street business buyers.

Customizable Deal: The ability to tailor the purchase to specific assets aligns with the buyer’s strategic goals, such as expanding product lines or entering new markets.

Benefits for Sellers

Retain Entity Control: Sellers keep the legal entity, which can be used for new ventures or wound down, offering flexibility in small business sales.

Streamlined Negotiations: Focusing on specific assets simplifies the deal, which is ideal for Main Street businesses like restaurants or retail shops.

Potential for Partial Exit: Sellers can sell key assets while retaining others, allowing a gradual transition out of the business.

Considerations

Asset purchases require careful review to ensure critical contracts, like leases or supplier agreements, are transferable, as non-transferable contracts can disrupt operations.

Sellers may face higher tax burdens, as asset sales can trigger ordinary income or corporate-level taxes, depending on the business structure.

Both parties should engage a small business broker or advisor to navigate these complexities and avoid unforeseen costs. Due diligence is essential to confirm asset conditions and values, ensuring a fair deal.

Stock Purchase

What It Is

A stock purchase involves the buyer acquiring the ownership shares of the business, taking control of the entire company, including all assets, liabilities, contracts, and obligations. This structure is common in small business acquisitions for incorporated entities like C-corps or S-corps.

How It Works

The buyer purchases the seller’s shares, becoming the new owner of the business entity. For instance, acquiring the stock of a small hardware store means inheriting its inventory, debts, leases, and permits.

A stock purchase agreement formalizes the deal, and thorough due diligence is critical to uncover hidden liabilities. This structure appeals to buyers seeking a seamless transfer of ownership.

Benefits for Buyers

Operational Continuity: Contracts, permits, and customer relationships remain intact, avoiding the need to renegotiate or reapply, which is valuable for small business buyers maintaining operations.

Simplified Acquisition: Acquiring the entire entity can be faster than sorting through individual assets, saving time in the business purchase process.

Strategic Growth: Buyers gain access to the business’s existing infrastructure, such as supplier networks or brand reputation, supporting expansion goals.

Benefits for Sellers

Tax Efficiency: Sellers often benefit from capital gains tax treatment, which may be lower than taxes on asset sales, making stock purchases attractive for small business owners selling their company.

Clean Exit: Selling all shares allows owners to fully exit the business without ongoing responsibilities, ideal for those retiring or moving on.

Faster Deal Closure: The straightforward transfer of ownership can expedite the sale.

Considerations

Buyers assume all liabilities, known or unknown, requiring extensive due diligence to mitigate risks like hidden debts or legal issues. This structure is less common for unincorporated businesses (e.g., sole proprietorships or LLCs) but suits small corporations.

Sellers should ensure compliance with corporate governance rules, and both parties should consult advisors to address tax and legal implications. A small business brokerage can help identify potential risks and streamline the process.

Employee Stock Ownership Plan (ESOP)

What It Is

An employee stock ownership plan (ESOP) is a specialized small business sale structure where the company creates a trust to transfer ownership shares to employees over time, fostering employee ownership. It’s a unique option for business owners looking to sell while preserving their legacy.

How It Works

The business establishes an ESOP trust, which uses company funds or borrowed capital to buy shares from the owner. Employees receive shares as part of their compensation, often gradually. For example, a small manufacturing firm might use an ESOP to transition ownership to its workers as the owner retires.

Legal and financial advisors ensure compliance with regulations, making this a viable option for stable lower-middle-market businesses.

Benefits for Buyers (Employees)

Employee Motivation: Ownership stakes boost morale, productivity, and retention, creating a committed workforce for the acquired business.

No Personal Investment: The ESOP trust funds the purchase, meaning employees don’t need personal funds, making it accessible for workers.

Cultural Continuity: Employees maintain the company’s values and operations, preserving its identity post-acquisition.

Benefits for Sellers

Tax Incentives: Sellers may defer capital gains taxes by reinvesting proceeds in qualified securities, a significant advantage for small business owners selling through an ESOP.

Legacy Preservation: The business continues under employee ownership, maintaining its culture and community presence.

Flexible Exit Timeline: Sellers can transition ownership gradually, staying involved during the process, which suits owners planning retirement.

Considerations

ESOPs involve setup costs and regulatory compliance, making them better suited for profitable businesses with 10–20+ employees, such as lower middle market firms. They’re less practical for very small Main Street businesses due to complexity and cost.

Both parties need experienced advisors to navigate legal and financial requirements, and sellers should assess the business’s cash flow to support the ESOP trust. Consulting a small business broker with ESOP expertise can ensure a smooth process.

Earnout Agreements

What It Is

An earnout agreement is a payment structure in small business acquisitions where part of the purchase price is paid later, based on the business achieving specific performance goals, such as revenue or profit targets. It’s often paired with asset or stock purchases to bridge valuation gaps.

How It Works

The buyer and seller agree on an upfront payment and future payments tied to performance milestones. For example, a buyer purchasing a small tech firm might pay 70% upfront and 30% over two years if the firm meets sales targets.

The earnout terms are outlined in the purchase agreement, requiring clear metrics to avoid disputes. This structure is useful in small business sales with uncertain future performance.

Benefits for Buyers

Risk Mitigation: Payments depend on performance, protecting buyers if the business underperforms, a key advantage in small business acquisitions.

Seller Support: Earnouts incentivize sellers to ensure a smooth transition, such as retaining key clients, enhancing deal success.

Flexible Financing: Buyers can spread payments over time, easing cash flow constraints when acquiring a Main Street business.

Benefits for Sellers

Higher Sale Price: Strong business performance can lead to a higher total payout, maximizing value for sellers.

Valuation Alignment: Earnouts resolve disagreements over the business’s worth, potentially enhancing the seller’s total compensation.

Continued Involvement: Sellers may stay engaged during the earnout period, ensuring a gradual exit while supporting the business.

Considerations

Earnouts require well-defined, measurable performance targets to prevent disputes, such as disagreements over revenue calculations. Both parties must agree on tracking and payment mechanisms, which can add complexity to the deal.

Buyers and sellers should work with legal advisors to draft clear terms and avoid conflicts. A small business brokerage can help negotiate earnouts to balance risk and reward effectively.

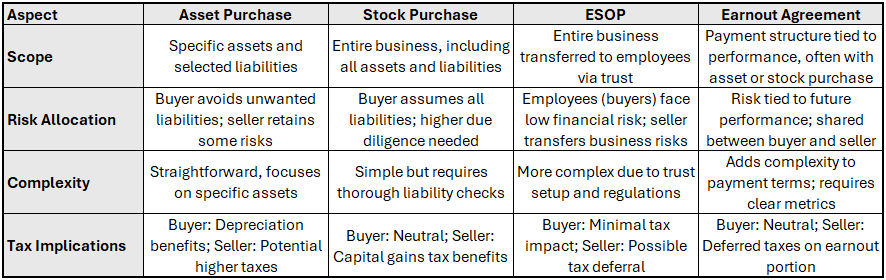

Comparing Deal Structures

The table below compares asset purchases, stock purchases, ESOPs, and earnout agreements across key factors to help small business owners and buyers choose the right deal structure.

Choosing the Right Deal Structure

Selecting the best structure for your small business acquisition or sale depends on your goals, the business’s legal structure (e.g., LLC, corporation), and financial considerations.

For Main Street businesses like cafes or retail shops, asset purchases are popular for their simplicity and flexibility. Lower middle market firms, such as small manufacturers or service providers, may prefer stock purchases for operational continuity or ESOPs for tax benefits and employee transitions. Earnouts are ideal when valuation disputes arise or future performance is uncertain.

To navigate these options, work with a small business broker, legal advisor, and tax professional to tailor the deal to your needs. By understanding these business sale structures, you can confidently plan your small business acquisition or sale, ensuring a smooth and successful transaction.

About the Author

Nick Piscani is the owner of Piscani Consulting Services. He helps business owners increase company value and plan successful exits. To learn what your business could be worth and how to increase that number, schedule a discussion today or email Nick at nick.piscani@piscaniconsultingservices.com.